The corporate training market saw notable activity during the third quarter of 2022, including multiple investments in workforce development solutions and services and a continued demand for learning technologies.

Last quarter also saw numerous acquisitions across market sectors, as corporate training providers team up to tackle widespread business challenges, from closing skills gaps to onboarding employees.

As we head toward the end of the year, let’s reflect on the deals that took place last quarter.

Increasing Demand for Workforce Development Solutions

In terms of activity, the workforce development sector of the market led the way in Q3. As organizations grapple with ongoing challenges such as employee engagement, widening skills gaps and retention, the demand for workforce development services and solutions that can help remains high. These challenges are unlikely to go away any time soon and, thus, we expect the demand for workforce development solutions to remain high next quarter and into the new year.

Here are the deals we took note of in this sector of the market last quarter:

- Clinical Education Alliance acquired Rockpointe Corporation, a health care education company and provider of accredited continuing education (CE) programs.

- Ed-tech company upGrad closed a $210 million investment round, the largest transaction noted in Q3. Global, Bodhi Tree and others participated in the funding round, and Founder Group also invested $12.5 million in the round to maintain their over 50% ownership in the company.

- GrowthSpace, a talent development company, announced a $25 million Series B funding round led by Zeev Ventures and existing investors. This investment brings the company’s total funding to $44 million.

- Chronus, a mentoring platform, acquired eMentorConnect, a cloud-based platform that helps teams and organizations configure their mentoring solutions.

- Cornerstone, a cloud-based talent management software company, completed its acquisition of SumTotal (previously a part of Skillsoft), a provider of learning and human resources (HR) solutions. According to the press release, the acquisition “will provide organisations with more power to build and strengthen their learning and talent management programmes, driving better people development and productivity.”

- upGrad announced the acquisition of Centrum Learning, further solidifying the company’s standing in the market.

Learning Technologies

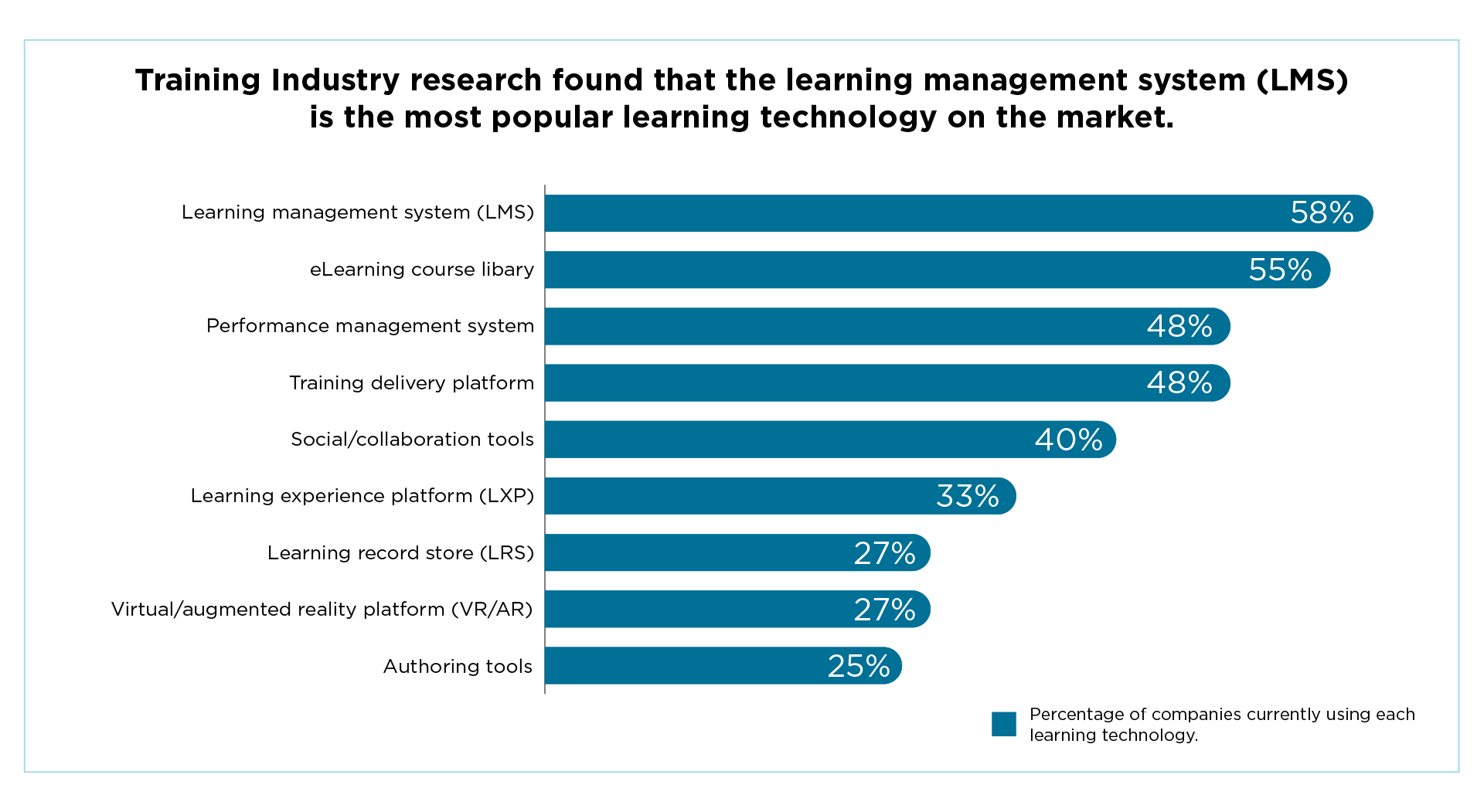

We’ve seen an increasing demand for learning technologies ever since the COVID-19 pandemic forced many companies to transition their in-person programs online. Training Industry’s “State of the Learning Technologies Market” report confirms that companies “purchased multiple learning technologies during the pandemic to secure a digital learning solution.”

Even with all the learning technologies available on the market, the report found that the learning management system (LMS) is still the most popular, with 58% of organizations currently using one (Figure 2).

It’s now been over two years since the onset of the pandemic, but the demand for learning technologies shows no signs of slowing down any time soon. Due to the widespread adoption of remote and hybrid work, companies are searching for learning technologies and solutions that can support their people — no matter where they’re located.

Here are the deals we noted in this popular segment of the market last quarter:

- Go1, one of the largest corporate training content hubs for on-demand learning, acquired Talivest, an employee experience platform. The acquisition will see Talivest’s co-founders and team “integrate as part of the Go1 global organization,” according to the press release.

- upGrad

- Francisco Partners, a global investment firm that specializes in partnering with technology businesses, announced that it would acquire Litmos from SAP. The transaction is expected to close in the fourth quarter of 2022.

- Benivo, an employee mobility management platform, announced a $12 million funding round led by Updata Partners.

- LMS365 announced the acquisition of workplace consultancy Evergreen Digital. The acquisition marks LMS365’s expansion into Australia, New Zealand and the wider Asia-Pacific.

Performance Management

The performance management sector of the market saw two deals last quarter:

- AXIOM Learning Solutions, a leading learning services organization, acquired PatternShifts, a performance improvement firm. Herb Blanchard, president of AXIOM Learning Solutions, says in the press release that PatternShifts “is a longstanding partner of AXIOM,” and that the acquisition will help strengthen the company’s capabilities.

- 15Five, a provider of continuous performance management solutions, secured $52 million in funding led by Quad Partners.

Onboarding

Even as we make our way toward what many deem the “new normal,” turnover remains a challenge for many organizations.

Thus, it makes sense that the onboarding sector of the market saw some activity last quarter, as companies look to get new hires up-to-speed quickly:

- Workstream, a mobile-first hiring and onboarding platform for the deskless workforce, raised an additional $60 million, bringing its total Series B financing to $108 million.

- Miratech announced the acquisition of TalentReef, an applicant tracking and onboarding platform designed primarily for hourly workers.

Leadership

In the leadership sector of the market:

- Kona, an employee experience platform for remote teams, closed a $4 million seed funding round led by Unusual Ventures.

- Hone, a people skills training platform, announced a $30 million Series B funding round led by 3L Capital, bringing the company’s total funding to $52.4 million.

Other Deals by Market Segment

Compliance

- Regulatory and compliance training provider 360training acquired tipsalcohol.com, a leading affiliate of TIPS (Training for Intervention Procedures) alcohol safety training.

- Wellable, an employee wellness technology and services provider, announced the acquisition of Sweat Factor, a leading fitness streaming platform.

Content Development and Personalization/Learning Pathways

- Knowledge Factor, Inc. (“Amplifire”), an adaptive eLearning and content creation platform, received an investment of an undisclosed amount from Polaris Growth Fund (PGF).

IT/Technical Training

- MidOcean Partners acquired Pragmatic Institute, a product management, data and digital design training provider.

- Korn Ferry announced its acquisition of Infinity Consulting Solutions (ICS), a provider of senior-level information technology (IT) interim professional solutions.

Measurement and Analytics

- Prometric announced the acquisition of Finetune, a Maine Venture Fund portfolio company and innovator in artificial intelligence (AI)-assisted education and workforce software tools.

Strategy, Alignment and Planning

- TiER1 Impact acquired XPLANE, a global design consultancy that helps large organizations clarify, communicate and activate their vision.

We love hearing from you! Email editor@trainingindustry.com to share your thoughts about last month’s activity, and your predictions for Q4.